Find Fast & Effective Personal Loans for 2025

- Easy & Efficient Process Saves Time

- Targeted Options Offer Great Results

- No Cost to Use AmONE

Our partners

Find a Personal Loan that Matches Your Needs

A Better Way to Get Great Loan Results

If you’re searching for a great personal loan to fit your needs, you’ve come to the right place.

Instantly Matched to Appropriate Solutions

AmONE’s easy and efficient process saves time by tailoring your solutions to your individual needs.

Highly Rated Providers Identified & Offered

AmONE’s targeted personal loan options bring the top lenders to you. Compare your options and choose your best offer.

Always Safe, Secure & Confidential

Get peace of mind knowing your personal information remains private and protected.

U.S. Based Live Support

Our helpful and friendly matching specialists are here to guide you through the process when you need help.

Here’s What Recent Users Have to Say About AmONE

Frequently Asked Questions

Personal loans work a bit differently than some other forms of consumer credit.

With a home or auto loan, for instance, you take on debt that’s backed by a physical asset – a house or a vehicle.

If you default on the loan, the creditor can seize the asset.

Unsecured personal loans work more like credit cards – you incur debt that’s not backed by a physical asset.

You don’t have to put up any collateral to get a personal loan, but you do have to demonstrate creditworthiness. That typically means a “good” credit score of 670 to 739. You’ll get the best loan terms if your credit is at or above the top of that range. Consumers with fair or poor credit scores can still qualify for personal loans with many lenders, but you’ll get less-favorable loan offers.

Personal loans have fixed monthly payments and set maturity dates. Loan length is commonly from 12 to 60 months. The annual percentage rate, or APR, is largely determined by your credit score.

Many consumers take out personal loans to consolidate their debt consolidation, which is the process of pooling multiple debt obligations into one payment through another form of consumer debt. There are many situations where a personal loan can make good financial sense, however. These include:

Paying off credit cards

Credit cards typically have high interest rates — that’s the price you pay for accessing unsecured credit. A personal loan with a significantly lower APR can save you thousands of dollars in interest if you are carrying substantial balances on multiple credit cards.

Pro: Creditworthy borrowers can find personal loan offers with an APR of less than 10% with many lenders.

Con: That could be half of what you are paying your credit card issuers. However, you’re only swapping one form of debt for another.

Pay off other debts and loans

You can use personal loan funds to pay off most forms of existing debt, including medical bills, auto loans, or payday loans. This strategy also can help you bring late accounts up to date if you’ve fallen behind. You may also be able to lower your monthly payments if you can secure a loan at favorable terms.

Pro: Rolling all or some of your debt obligations into one fixed payment makes it much easier to manage your debt.

Con: Some existing debts, such as medical bills, don’t usually accrue interest, so a personal loan might cost you more over the length of the loan.

Home improvement

Many people don’t have thousands of dollars in their checking accounts to pay for big-ticket home improvement projects. A personal loan can help you pay for necessary home improvements such as a new water heater, air conditioner or septic system. Depending on how much additional debt you want to take on, you could even take out a personal loan to fund a complete kitchen or bathroom remodel.

Pro: A personal loan allows you to make payments on expensive HVAC or other important home repairs.

Con: you’ll be taking on more debt as well as adding to your monthly expenditures if you fund those purchases with a personal loan rather than using savings or a home equity loan.

Start or improve a business

Starting a business can be costly.

A personal loan can help pay for initial startup costs, taxes, and regulatory fees, as well as inventory, rent, payroll or tenant improvements. Unlike a small business loan from the Small Business Administration, you won’t have to show lenders much more than your creditworthiness.

Pro: A personal loan can help you get your business off the ground or pay for some key expenditures.

Con: If your business fails, you’ll still have to pay back the money. If your business is languishing in red ink, a personal loan may just be postponing the inevitable.

Get caught up on bills

Falling behind on monthly household bills, alimony or child support payments can bring on depression and a sense of hopelessness. You can even go to jail for failing to pay court-ordered child support.

You can get caught up on all your back payments with a personal loan.

Pro: Getting caught up on bills alleviates stress and staves off despair.

Con:Taking on more debt when you are already struggling financially might not be your best option.

Get cash for an emergency

It’s difficult to plan for the unexpected.

Emergencies can include a flooded basement, blown engine in your car, or an unexpected surgery. Many lenders can deliver funds to help you pay for emergencies in the same day or one to two business days.

Pro: Emergency loans are delivered fast, and you can pay off emergency expenses with manageable monthly payments that won’t take a big bite out of your monthly budget.

Con:Make sure you are in a strong enough financial position to handle additional debt.

Personal loans aren’t the only way to quickly get some cash when you need it. Here are three alternatives to personal loans:

Get cash for an emergency

If you don’t need thousands of dollars, and you can pay the balance off in a few months, your credit card might be your best option.

Home equity line of credit (HELOC)

Many consumers use the equity in their homes for large purchases, especially those related to their homes.

Small Business Administration (SBA) loan

The SBA can help match you with local lenders where you might qualify for a small business loan. The SBA’s microloan program offers up to $50,000 to help start or expand a business.

Creditworthy borrowers will receive the best rates on personal loans.

Consumers with poor or bad credit — a FICO score below 580 — can still qualify for personal loans through some lenders.

Qualification criteria varies, but 580 to 600 is often the minimum credit score. Interest rates could exceed 35%, which makes the payment much higher and you’ll pay a lot more in interest.

Personal loans are usually the best options for large purchases — say $10,000 or more. Credit cards, meanwhile, often work well to finance more modest-sized purchases. There are pros and cons to both.

Credit cards are revolving credit, so your payment will vary depending on how much you owe. If you add a $5,000 purchase to your credit card and you already have a $5,000 balance, your payment will be above $300 a month and you’ll also pay a lot in interest.

Personal loans, on the other hand, have fixed payments and maturity dates. A new credit card might come with a low introductory APR on purchases or if you transfer a balance from another card, so that path might work in your favor.

Your credit score is probably the single-most important requirement for getting a personal loan. You’ll also have to verify your address and guaranteed monthly income. Some lenders may want to look at your existing debt obligations to calculate your debt-to-income ratio (DTI) to determine if you have the financial wherewithal to pay back the loan. You’ll have to complete a loan application, which may result in a hard pull on your credit file through one of the three credit-reporting agencies.

Before applying for a personal loan, have these documents at the ready:

• Proof of identity, such as a driver’s license or other form of government- or state-issued ID • Proof of income, such as W2 statements • Bank statements • Tax returns if you are self employed

Documentation requirements likely will vary by lender, however.

If you’ve weighed your options and decided that taking out a personal loan is your best option, here are a few things to keep in mind:

Don’t take the first attractive offer

Don’t jump on the first offer, especially if you know you have good credit. Shop around for the best rate.

Borrow only what you need

Just because you can borrow $30,000 doesn’t mean you should. Avoid temptation and stick to the barest minimum amount that meets your needs.

Never miss a payment

Late or missed payments are a death-knell for your credit score. Set up automatic payments or set calendar alerts to inform you when it’s time to make another monthly payment.

Don’t borrow if you are struggling financially

A personal loan will provide a cash infusion, but if you are in dire financial straits you’re only compounding the problem. Figure out ways to cut your expenses instead.

If you’ve weighed your options and decided that taking out a personal loan is your best option, here are a few things to keep in mind:

Don’t take the first attractive offer

Don’t jump on the first offer, especially if you know you have good credit. Shop around for the best rate.

Borrow only what you need

Just because you can borrow $30,000 doesn’t mean you should. Avoid temptation and stick to the barest minimum amount that meets your needs.

Never miss a payment

Late or missed payments are a death-knell for your credit score. Set up automatic payments or set calendar alerts to inform you when it’s time to make another monthly payment.

Don’t borrow if you are struggling financially

A personal loan will provide a cash infusion, but if you are in dire financial straits you’re only compounding the problem. Figure out ways to cut your expenses instead.

We’ve made it easy for you to complete the loan search process and pair you with lenders that meet your qualifying standards.

Here’s how it works:

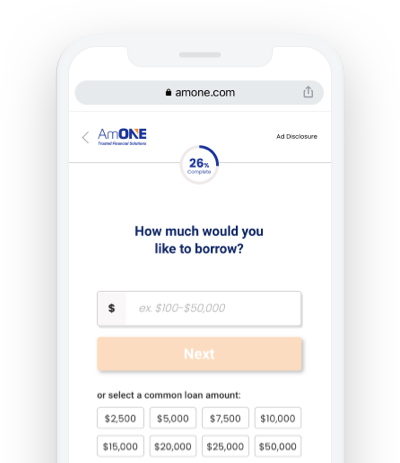

Fill out the form

Start by selecting how you will use the funds, whether it be for debt consolidation, a special event, home improvement, or something else. Decide how much you want to borrow, plug in some personal information, and get your results.

Get offers

Once you complete the initial application form, you’ll be matched with a wide range of lenders. We’ve broken down potential loan offers into different categories, such as lowest APR, lowest monthly payment, and top loan offers.

Weigh options

Scan through your potential loan offers to determine which terms best meet your needs. Annual percentage rates, loan limits and repayment terms vary by lender.

Call AmONE

We’re here if you need some one-on-one support. You can call AmONE or contact us online if you need additional help.

Choose your offer

Select your preferred lender and complete their loan application. The information you already provided will carry over to the new loan application, saving you time and making it easy to complete the process.

Get funded

Once you’ve completed the application and your loan has been approved, you’ll receive your funds. Personal loans are typically dispersed via direct deposit to your checking account.

Use your money

After the funds have hit your bank account, you can use them to make that major purchase, pay off your credit cards, or whatever else you need.